Did you know you can support charities like 2wish straight from your salary without lifting a finger? It’s called Payroll Giving, and it’s one of the easiest ways to make a difference.

Payroll Giving is a scheme that lets you donate to charity directly from your pay before tax is deducted. That means more of your money goes to the cause, and it costs you less.

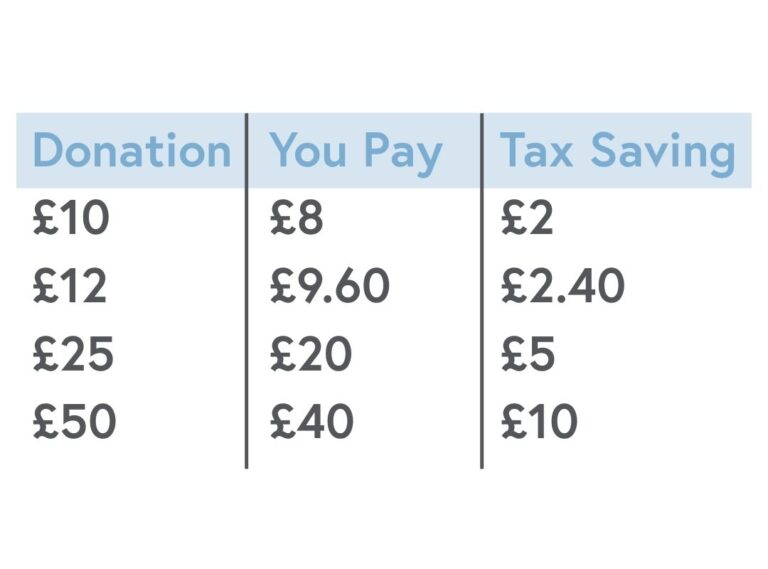

For example, a £10 donation might only cost you £8 but 2wish receives the full £10. For higher tax earners the cost to the employee would be £6 with the charity still receive the full £10.

Higher-rate taxpayers save even more.

You can learn more about payroll giving and calculate your donation here

Your regular donation helps 2wish provide vital support to families affected by the sudden death of a child or young adult.

Just some of the ways your donation will help include:

It’s simple to sign up. Just speak to your HR or payroll team and ask if your organisation offers Payroll Giving. If they do, you choose the amount, and it’s deducted automatically each month. No hassle, just impact.

It’s really easy to get started! If your employer doesn’t already have a Payroll Giving scheme, they can register with an approved Payroll Giving agency.

These agencies handle the donations and make sure your chosen charity, like 2wish, receives the funds securely and efficiently.

Some trusted Payroll Giving agencies include:

Employers can set it up in just a few steps and once it’s in place, employees can start giving straight from their salary, tax-free.

reach out to our partnership team if you have any further questions or queriest: [email protected]

2wish Head Office

Unit 3, Sovereign Court

Sterling Drive

Llantrisant

Rhondda-Cynon-Taff

CF72 8YX